The air cargo market is losing altitude and fast.

When the Tides Turn: How the Panama Canal Is Fueling Ocean Rate Volatility

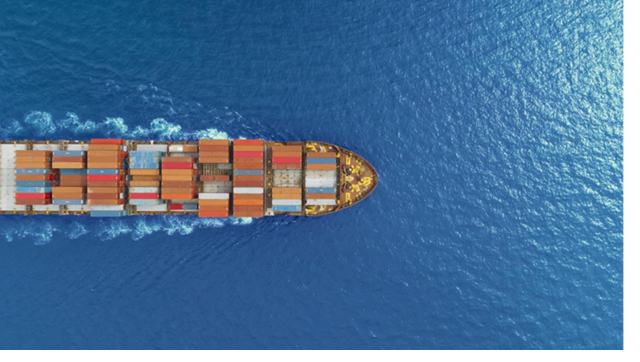

Ocean shipping has always been an industry that lives and dies by timing — and lately, the clock’s been unpredictable. In 2025, global freight rates are once again swinging sharply, even though demand has not seen much change. The culprit isn’t just the economy or consumer spending; it’s the world’s waterways themselves.

At the center of it all sits the Panama Canal — a vital artery for global trade that’s been showing its fragility. The Canal’s struggles with water levels, vessel backlogs, and climate shifts are directly contributing to the ups and downs of ocean shipping rates. And while conditions have improved this year, the damage has already been done; volatility has become the new normal.

The Ripple Effect: When Weather Becomes a Pricing Problem

Last year’s record drought forced the Panama Canal Authority to limit the number of daily vessel crossings — cutting slots nearly in half at one point. That single operational change sent ripples through global trade.

Carriers that once relied on quick passage between the Pacific and Atlantic had to reroute thousands of miles around the Cape of Good Hope or through the Suez Canal. Suddenly, a route that normally takes 22 days now takes nearly a full month. Extra sailing time meant higher fuel use, delayed deliveries, and mounting costs that inevitably flowed down to shippers and customers.

To offset those costs, carriers tacked on “Panama Canal surcharges.” Spot container rates jumped on Asia–U.S. East Coast lanes, and even routes untouched by Panama felt the squeeze.

And while the rain has since returned, experts warn that climate volatility could make these kinds of disruptions more frequent. The big takeaway? Water levels aren’t just a weather story anymore — they’re a pricing story.

When One Chokepoint Ripples Through the World

What’s happening in Panama isn’t isolated. Every time a bottleneck forms — whether in the Canal, the Red Sea, or the Suez — it throws the global balance of vessel capacity off-kilter and here’s how it plays out:

When ships are forced to detour thousands of miles, they spend more time at sea. That means less available capacity, even if the total number of ships stays the same. The longer voyages burn more fuel, the more bunker costs increase, and sailing efficiency decreases.

When normal routes reopen and all that delayed capacity floods back into the market, rates drop fast — creating the rollercoaster effect we’re seeing now. Even today, with water levels in Panama improving, the shipping industry is feeling whiplash. After months of high prices driven by canal restrictions and Red Sea diversions, rates are now sliding downward as capacity normalizes, and new vessels hit the market.

In short: the world’s chokepoints are creating a global game of musical chairs — and ocean carriers are paying the tune.

What Supply Chain Leaders Can Do Now

If there’s one lesson supply chain leaders can take away, it’s that stability can no longer be assumed. Freight pricing, capacity, and routing are all tied to unpredictable environmental and geopolitical factors.

A Few Smart Moves They Can Make Now:

- Watch the chokepoints. Keep an eye on updates from the Panama Canal Authority, Red Sea transit data, and weather forecasts — they’re now early warning signs for freight volatility.

- Build flexibility into routing. Explore alternate ports and rail options. For example, use U.S. West Coast entry points with intermodal transfers if Panama issues return.

- Rethink contract structure. Mix fixed-rate and spot-rate contracts to avoid being trapped when rates swing up or down.

- Invest in visibility tools. Real-time vessel tracking and predictive analytics can help you anticipate the next capacity squeeze.

The Bottom Line

The Panama Canal’s recent troubles have done more than delay cargo — they’ve exposed how sensitive the global shipping network really is. Every drought, detour, and backlog becomes a shock that ripples across oceans, ports, and balance sheets.

Here is the new reality: ocean rates will keep swinging as long as infrastructure remains vulnerable, and weather patterns stay unpredictable. For supply chains, success won’t come from guessing where rates go next — it will come from building resilience that can handle whatever direction the tide turns.

For more information on Aquatio Software supply chain visibility solutions, visit us at aquatiosoft.com.